Last update 2024-12-09

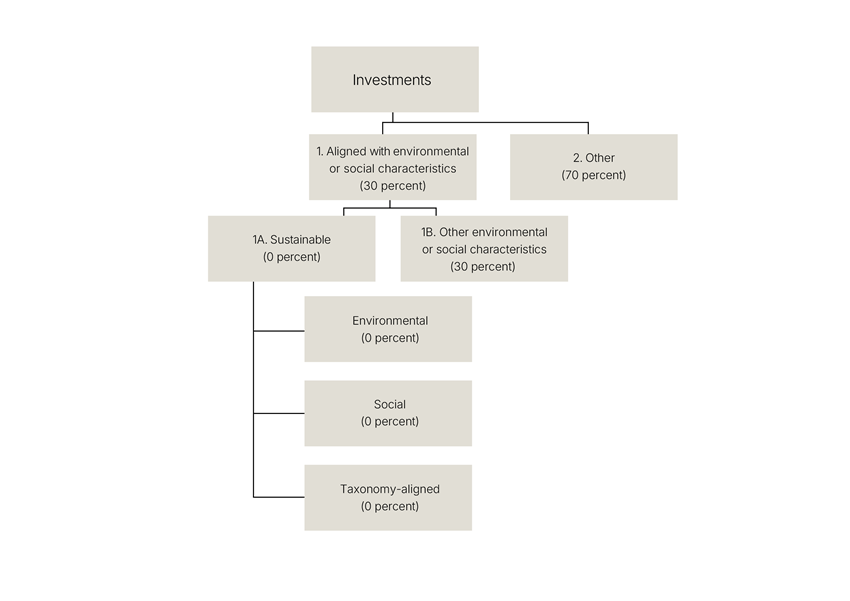

The foundation of Strivo's discretionary portfolio management service (“The Service”) is the belief that responsible investments and returns for investors are closely connected. The Service reports in accordance with Article 6 of the SFDR (EU Disclosure Regulation), and 30% of the Service’s asset value must consist of investments that promote environmental or social characteristics. The Service does not commit to any minimum requirements for sustainable investments.

Strivo AB ("the Company") considers sustainability risks as part of the decision-making process in its investment strategy. These risks may negatively impact the value of investments. The assessment is that the overall impact on returns in the short term is relatively limited. Investment objects with high sustainability risks entail a greater risk of increased costs, which may negatively affect the Service. The Company assesses that the work of reviewing investment objects and their associated sustainability risks could positively impact the risk-adjusted return of each mandate in the long term. Investment objects with lower sustainability risks may have a greater potential to achieve long-term profitability and, consequently, a higher potential to generate better returns in portfolio management at a lower risk over time.

The Company has developed policies and processes to ensure that the investment objects meet the sustainability objectives set for the Service. A sustainable investment, as defined in the SFDR, refers to an investment in economic activities contributing to an environmental and/or social goal, provided that such investments do not cause significant harm to other environmental or social objectives and adhere to good governance practices. The Company measures contributions to sustainability goals against the UN’s 17 Sustainable Development Goals (SDGs) and applies the EU Taxonomy to determine what qualifies as a sustainable investment.

Strivo considers an investment to promote sustainability if it:

- Contributes to environmental or social goals as outlined in the UN SDGs.

- Aligns with targets under the Paris Agreement, such as setting and validating climate goals through the Science Based Targets Initiative.

Investment Strategy

The Service incorporates four methods in its investment strategy to integrate sustainability:

Method 1: Sustainability Analysis

Investments are made in securities that are pre-analyzed and continuously rated using the Company’s internal analysis tool.

Method 2: Exclusion

To reduce sustainability risks and negative impacts, the Service applies an exclusion strategy. This involves excluding investment objects that violate UN Global Compact principles, OECD Guidelines for Multinational Enterprises, or fall under the Company’s exclusion list.

Method 3: Active Ownership

On behalf of investors, the manager engages in dialogue with both existing and potential investment objects to encourage improved ESG practices.

Method 4: Sustainability Assessment

Even though the Company does not do sustainable investments, a method of investing sustainable still needs to be established. To classify a holding as sustainable, it must align with the Company's framework for sustainable investments or the Service’s promoted characteristics. Investments must pass the Company’s “Do No Significant Harm” test and adhere to good governance practices.

Criteria for Sustainable Investments

The Company considers an investment to contribute to sustainability goals if:

- It supports one or more UN SDGs, with a focus on Goals 5, 9, 11, 13, and 16.

- At least 15% of the revenue, capital expenditures, or operational expenses of the investment object are EU Taxonomy-aligned.

The negative impact of investments on sustainability factors is an integral part of the Service’s investment process. Investments are evaluated to ensure they do not cause significant harm concerning relevant and selected sustainability factors (PAI indicators).

The manager strives to ensure the most comprehensive and reliable information possible about the Service’s investments. Data for sustainability analysis is sourced from external providers. When selecting an ESG data provider, the Company assessed market options based on functionality, the number of sustainability analysts, methodology, pricing, and data quality. This evaluation of sustainability providers is an ongoing process. However, the Company cannot guarantee that the information obtained is always complete or accurate.

Where shareholder influence is expected to have a tangible impact, the Company engages with the entities the Service invests in, following its shareholder engagement policy. The Company may also exert influence by engaging with managers of collective investment vehicles, such as funds in which it invests.

An annual sustainability report is published, detailing the engagement activities carried out in the previous year.

No objective for sustainable investments

This financial product promotes environmental and/or social characteristics without having sustainable investments as its objective.

Environmental and/or Social Characteristics of the Financial Product

The Company has developed policies and processes to ensure that the investment objects align with the sustainability objectives set for the Service. Sustainability is therefore assessed and valued on par with the fundamental and technical attributes of the investments. The Service aims to invest in companies and funds that proactively work towards a sustainable environment.

This means the Service promotes the following characteristics:

- Activities that contribute to an environmental or social goal as outlined in the UN’s Sustainable Development Goals (SDGs), with a focus on Goals 5, 9, 11, 13, and 16.

- Investment objects aligned with the emissions targets of the Paris Agreement, including those with climate goals validated by the Science Based Targets Initiative.

Analysis

The Service is a discretionary portfolio management service with a global focus, divided into several model portfolios with distinct objectives and diversification strategies.

Pre-Investment Analysis

The Service applies exclusion criteria based on sustainability considerations. Investment objects operating in sectors deemed ethically controversial or associated with significant sustainability risks by the manager are excluded from the Service’s investment universe for direct investments.

The Service excludes investment objects associated with:

- Cluster munitions, landmines, chemical/biological weapons

- Nuclear weapons

- Pornography (if revenue exceeds 5%)

- Alcohol and tobacco (if revenue exceeds 10%)

Additionally, investment objects involved in violations of the UN Global Compact or the OECD Guidelines for Multinational Enterprises are excluded.

The Company has developed a specialized tool for sustainability analysis, ensuring each investment object in the Service’s universe is evaluated and scored using this tool (the “Sustainability Matrix”).

Key Features of the Sustainability Analysis:

- Ex-Ante Evaluation: The analysis is conducted prior to trading to ensure that only investments meeting the internal minimum ESG score are eligible for inclusion.

- 17 Sustainability-Related Questions: These questions form the basis for an internal ESG scoring system, categorizing investment objects as:

- Non-sustainable: 0–15 points

- Neutral: 15–25 points

- Sustainable: 25–37 points

The questions address various aspects, such as:

- Whether the investment object engages in activities listed on the Service’s exclusion list.

- Whether the object has established climate goals validated by the Science Based Targets Initiative.

- Governance practices, including management structure, employee relations, compensation practices, and tax compliance (aligned with good governance standards).

- The potential for the Company to influence the investment object to adopt more sustainable practices.

Post-Investment Analysis

The analysis is updated annually to ensure that investment objects continue to meet the sustainability goals defined at the time of the initial investment.

If the investment object is covered by the Company’s chosen sustainability data provider, the provider’s assessments and ratings are included in the composite ESG scoring.

Ongoing Engagement:

- The manager engages in dialogue with both current and potential investment objects to communicate the Service’s sustainability commitments.

- Collaboration with other investors, participation in shareholder meetings, and voting are also employed to influence companies.

Assessment of Good Governance

The Company evaluates the governance of investment objects using its internal Sustainability Matrix, focusing on:

- Management Structure: Policies on corruption and bribery.

- Employee Relations: Practices supporting freedom of association and collective bargaining.

- Compensation: Structures for employee remuneration and votes against remuneration reports.

- Tax Compliance: Indicators of tax-related incidents.

The established criteria ensure investment objects do not violate the OECD Guidelines for Multinational Enterprises or the UN Guiding Principles on Business and Human Rights.

Share of Investments